JOIN US JUNE 16 - 19, 2025!

MGM GRAND HOTEL & CASINO - LAS VEGAS, NV

TAX EDUCATION • NETWORKING • GROWTH

Latino Tax Fest is the national conference for all tax professionals, including Enrolled Agents, CPAs, and others who aspire to grow, lead, and pursue continuous education in the tax industry.

2025 is The Year of Opportunity to expand your expertise, connect with like-minded professionals, and discover new pathways to success in a rapidly evolving industry.

JOIN US TO INVEST IN YOUR FUTURE AND CAREER!

2025 SCHEDULE

Continuing Education – Intermediate

(CA) California Tax Law | (T) Tax Law | (E) Ethics | (U) Updates

Attendees that need to complete 5 hours of California tax law

must be present on Monday, June 16, 2025.

For all other attendees, we will have optional bonus sessions!

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 6:00 pm | Pick-Up Badge at Registration Desk | |

| 9:00 am – 9:50 am | (1T) How to Fill out Form 2848 & Read IRS Transcripts Mark J. Dombrowski, EA | (1T) Cómo llenar el Formulario 2848 y leer transcripciones del IRS Astrid Galvez, EA |

| 10:00 am – 10:50 am | (1T) Penalty Abatement Techniques from Denials to Appeals Mark J. Dombrowski, EA | (1T) Técnicas para la Reducción de Multas: De Denegaciones a Apelaciones Luis Parra, EA |

| 11:00 am – 12:00 pm | Break | |

| 12:00 pm- 12:50 pm | (1CA) Differences in Depreciation Josue Rojas, EA | (1CA) Diferencias en la depreciación Andres Santos, EA |

| 1:00 pm – 1:50 pm | (1CA) California Tax Topic Karolyna Sandoval, Covered California | (1CA) Reglas de bienes gananciales Raul Escatel Atty. |

| 2:00 pm – 2:50 pm | (1CA) Community Property Rules Raul Escatel Atty. | (1CA) Ley de impuestos de California Yadia Lopez, Covered California |

| 3:00 pm – 3:50 pm | (1CA) Pass-Through Entity Elective Tax Laura Nava, CPA | (1CA) Factores que disparan auditorías del FTB y errores comunes Raul Escatel Atty. |

| 4:00 pm – 4:50 pm | (1CA) FTB Audit Triggers & Common Pitfalls Raul Escatel Atty. | (1CA) Impuesto Electivo para Entidades de Traspaso Antonio Nava, EA |

| 5:00 pm – 7:00 pm | Meet ‘n Greet | |

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 8:00 am | Pick-Up Badge at Registration Desk | Coffee & Pastries Available | |

| 8:00 am – 8:50 am | (English Only) (1E) Building a Sustainable Practice through Ethics Sharyn Fisk, JD, LLM | |

| 9:00 am – 9:50 am | (English Only) (1U) Tax Updates Irene Jimenez-Muir, Supervisory Compliance Investigator, State of Nevada | |

| 10:00 am – 10:50 am | (English Only) (1U) What’s the forecast for 2025 & Beyond? Keynote Panel: Carlos Lopez, Terry Lemons, Charles Rettig | |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart, Ballet Folklorico | |

| 1:00 pm – 1:50 pm | (1T) ITIN Challenges Nejla Smith, CPA | (1T) Lo que se debe y no se debe hacer con las S Corps Nadia Rodriguez, CPA |

| 2:00 pm – 2:50 pm | (1T) Do’s & Don’ts of S Corps | (1T) Problemas comunes con el ITIN Nejla Smith, CPA |

| 2:50 pm – 3:10 pm | Break Activities: Breakout Sessions | |

| 3:10 pm – 4:50 pm | (2T) Pen to Paper: Preparing a Basic Form 1041 Alice Orzechowski, CPA | (2T) Del Papel al Formulario: Cómo Preparar un Formulario 1041 Básico Luis Parra, EA |

| 5:00 pm – 7:00 pm | Mariachi Mixer | |

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 8:00 am | Pick-Up Badge at Registration Desk | Coffee & Pastries Available | |

| 8:00 am – 9:40 am | (2T) Foreign Assets: Increasingly More Difficult to Hide and Expensive When Caught Alice Orzechowski, CPA |

Luis Parra, EA |

| 10:00 am – 10:50 am | (1E) Understanding Ethics: Violations and Punishment Sharyn Fisk, JD, LLM | (1E) Entendiendo la Ética: Infracciones y Sanciones Luis Tejada, Atty. |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart | |

| 1:00 pm – 1:50 pm | (1T) Who has to report their foreign income? Fernando Juarez, Atty. | (1T) Depreciación Ricardo Rivas, EA |

| 2:00 pm – 2:50 pm | (1T) Depreciation Ricardo Rivas, EA | (1T) ¿Quién debe reportar sus ingresos extranjeros? Fernando Juarez, Atty. |

| 2:50 pm – 3:10 pm | Break Activities: Breakout Sessions | |

| 3:10 pm – 4:00 pm | (1T) Audit Reconsideration What, Why, When & How Alan Pinck, EA | (1T) Reconsideración de Auditoría: Qué es, Por Qué ocurre, Cuándo solicitarla y Cómo hacerlo Astrid Galvez, EA |

| 4:10 pm – 5:00 pm | (1T) How to Survive a Tax Preparer Audit Josue Rojas, EA | (1T) Cómo Sobrevivir a una Auditoría de Preparador de Impuestos Andres Santos, EA |

| 7:00 pm – 10:00 pm | POOL PARTY FEATURING

| |

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 8:00 am | Registration Desk Open | Coffee & Pastries Available | |

| 8:00 am – 8:50 am | (1T) Schedule E Explained: A Line-by-Line Walkthrough for Tax Preparers John Sapp, CPA | (1T) Explicación del Schedule E: Guía Paso a Paso para Preparadores de Impuestos Jesus Casas, CPA |

| 9:00 am – 9:50 am | (1T) Amending & Correcting Returns | (1T) Enmiendas y correcciones de declaraciones Laura Nava, CPA |

| 10:00 am – 10:50 am | (1T) Understanding where to report the income on Form 1099-K Alan Pinck, EA | (1T) Cómo Reportar los Ingresos del Formulario 1099-K Astrid Galvez, EA |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart | |

| 1:00 pm – 1:50 pm | (1T) Schedule C: Reporting Business Income & Expenses Wolters Kluwer | (1T) Ley de impuestos Carlos Lopez, EA, CEO |

| 2:00 pm – 2:50 pm | (1T) Tax Law Carlos Lopez, EA, CEO | (1T) Schedule C: Reportando Ingresos y Gastos Empresariales |

| 2:50 pm – 3:10 pm | Break Activities: Breakout Sessions | |

| 3:10 pm – 4:00 pm | (1T) Expanded Enforcement: Combating Escalating IRS Correspondence Protection Plus | (1T) Aplicación Reforzada: Enfrentando el Aumento de Correspondencia del IRS Astrid Galvez, EA |

| 4:10 pm – 5:00 pm | (1U) 2026 Changes on SSA, TIPS, and TCJA ADP | (1U) Cambios de Trump en el SSA, TIPS y TCJA para 2026 |

* Schedule subject to change to ensure the best experience for our attendees. Please check for updates regularly *

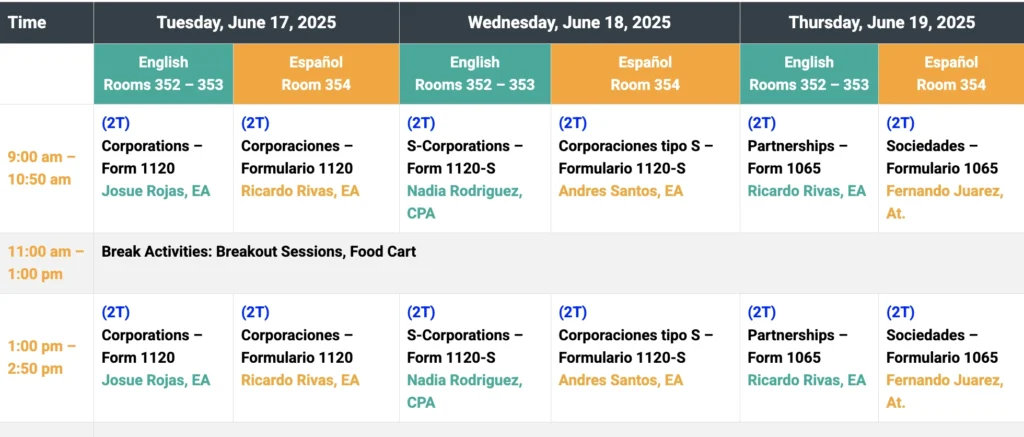

ADVANCED TRACK

Line-by-Line Tax Filing Guide for Corporations & Partnerships

Join the advanced Corp Class at Latino Tax Fest from June 17 – 19, 2025, 9 AM – 3 PM each day, for an in-depth look at business tax returns, including Forms 1065, 1120, and 1120-S.

Limited seats available! These sessions will run concurrently with the main sessions, so please choose your track carefully.

Eligibility: Available to attendees with a Tax Pro Pass for an additional fee of $179, or included with the VIP Pass. Purchase at checkout or RSVP for the VIP Pass to secure your spot.

Time | Tuesday, June 17, 2025 | Wednesday, June 18, 2025 | Thursday, June 19, 2025 | |||

|---|---|---|---|---|---|---|

English Rooms 352 – 353 | Español Room 354 | English Rooms 352 – 353 | Español Room 354 | English Rooms 352 – 353 | Español Room 354 | |

| 9:00 am – 10:50 am | (2T) Corporations – Form 1120 Josue Rojas, EA | (2T) Corporaciones – Formulario 1120 Ricardo Rivas, EA | (2T) S-Corporations – Form 1120-S Nadia Rodriguez, CPA | (2T) Corporaciones tipo S – Formulario 1120-S Andres Santos, EA | (2T) Partnerships – Form 1065 Ricardo Rivas, EA | (2T) Sociedades – Formulario 1065 Fernando Juarez, At. |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart | |||||

| 1:00 pm – 2:50 pm | (2T) Corporations – Form 1120 Josue Rojas, EA | (2T) Corporaciones – Formulario 1120 Ricardo Rivas, EA | (2T) S-Corporations – Form 1120-S Nadia Rodriguez, CPA | (2T) Corporaciones tipo S – Formulario 1120-S Andres Santos, EA | (2T) Partnerships – Form 1065 Ricardo Rivas, EA | (2T) Sociedades – Formulario 1065 Fernando Juarez, At. |

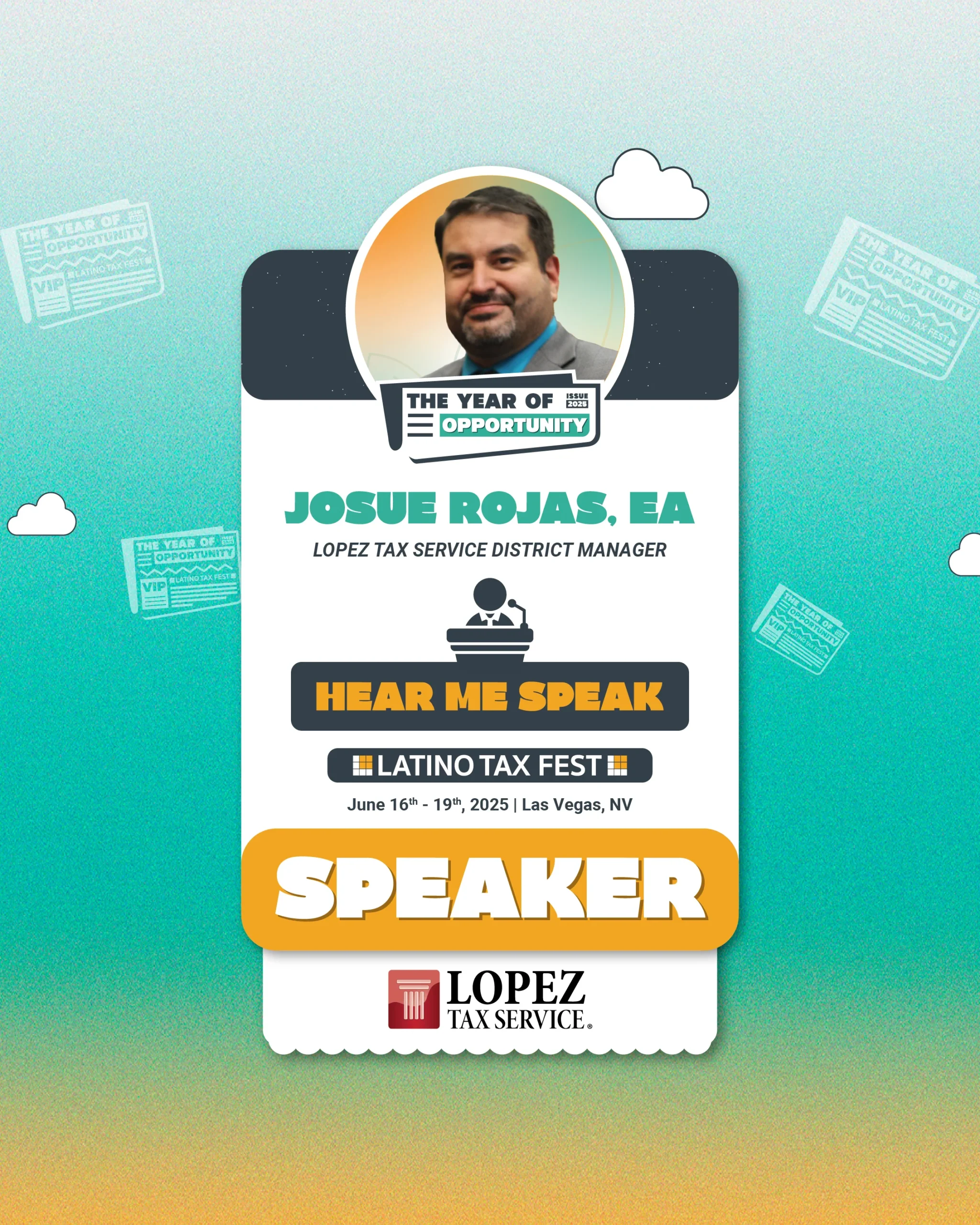

MEET OUR SPEAKERS

VISIT OUR EXHIBITORS

Unlock Your Full Potential

EARN CONTINUING

EDUCATION CREDITS 📚

If you’re from California, you won’t have to worry about exams; you can earn your required credits simply by attending all four days.

If you’re renewing your Annual Filing Season Program (AFSP), you can obtain a significant portion of your required credits. All you need to do is take the Annual Federal Tax Refresher (AFTR) exam after attending the Tax Fest; this exam fee is already included in your ticket price.

DISCOVER OFFICE SOLUTIONS

AT OUR MARKETPLACE 👩🏻💻

The Tax Fest features one of the largest industry Marketplaces with over 73 exhibitors. Attendees can connect with various software providers and companies specializing in tax-related tools and solutions. This provides a unique opportunity to explore the latest technology in tax software, cloud-based platforms, and other services that can streamline and improve tax preparation and filing processes. Be sure to visit our preferred providers!

NETWORK WITH MULTICULTURAL

TAX PROS 💃🏻🕺🏻

Get ready to experience networking like never before at the Tax Fest, where every event feels like a celebration! Kick off the excitement at Monday’s Meet n’ Greet with drinks and connections, then turn up the energy on Tuesday at the Mariachi Mixer, a dance-filled fiesta featuring a live mariachi band. Wrap up your experience at Wednesday’s world-famous pool party, complete with a live salsa band and plenty of fun to cool down after a day of learning. This is networking reimagined—a high-energy, unforgettable celebration designed to create lasting connections with fellow tax pros.

Need help getting approval to attend? Click below for key talking points and an email template!

ATTENDING THE CLASSES? PICK ONE OF THESE PASSES TO GET STARTED!

TAX PRO PASS

$549

Included with your pass:

- Full 4-day access to Classrooms and 3-day access to the Marketplace

- Earn up to 23 Continuing Education (CE) credits

- Includes access to all mixers: Meet & Greet, Mariachi Mixer, and Pool Party

- Includes Annual Federal Tax Refresher (AFTR) Exam

ONLY 200 AVAILABLE!

ALL ACCESS PASS

$1,200

Included with your pass:

- One Tax Pro Pass

- Advanced Track: Line-by-Line Tax Filing Guide for Corporations & Partnerships *

- Expedited Fast Track Badge Pick-Up

- Exclusive VIP Merchandise: VIP lanyard, 8oz Yeti Tumbler, VIP Special Edition T-Shirt & Backpack, $100 Gift Card to spend at the MGM

- Access to a Private Lounge: Complimentary Water and Snacks

- Reserved Seating in the Classrooms

* RSVP is required to secure your spot. Once maximum capacity is reached, additional attendees will not be able to participate.

ONE DAY PASS

$299

Included with your pass:

- Full 1-day access to Classrooms and the Marketplace

- Earn only available credits for day attended

- Includes access to Mixer for day attended

CAN'T MAKE IT TO VEGAS THIS YEAR?

WATCH OUR LIVE STREAM TO EARN YOUR CREDITS AND GET UPDATED.

LIVE STREAM

$399

Included with your pass:

- 3-day access to streaming of main sessions

- Earn up to 21 Continuing Education (CE) credits

- Includes Annual Federal Tax Refresher (AFTR) Exam or California 5-Hour Self-Study

ACT NOW AND SAVE YOUR SEAT! TAX PRO PASS PRICES WILL BE INCREASING!

| Year-End Price $399 June 27 – December 31, 2024 | Early Bird Price $499 January 1 – March 31, 2025 | Regular Price $549 April 1 – May 31, 2025 |

| Late Registration Price $599 June 1 – June 16, 2025 | On-Site Price $649 June 16 – 19, 2025 | 2026 Show Special Only available at the Tax Fest! |

INTERESTED IN NETWORKING OR A GUEST? HERE ARE YOUR OPTIONS.

MARKETPLACE PASS

$349

Included with your pass:

- 3-day access to the Marketplace

- Includes access to all mixers: Meet & Greet, Mariachi Mixer, and Pool Party

Note: This pass does not include classroom access or eligibility for CE credits.

POOL PARTY PASS

$100

Included with your pass:

- Access to the pool party only on Wednesday

Note: This pass does not include access to classrooms, the marketplace, or CE credits.

Need more information? Call or text us at (866) 936-2587 for questions.

Participants with disabilities will receive reasonable accommodations as set forth by the LTP. Additional accommodations will be provided at a cost to participants, including personal devices.

The Accessibility Support Pass ($349) is for guests assisting handicapped attendees with a Tax Pro Pass.

- Full 4-day access to Classrooms and 3-day access to the Marketplace

- Access to all mixers: Meet & Greet, Mariachi Mixer, and Pool Party

Note: This pass does not include eligibility for CE credits.

Under the age of 16.

Child Pass is available for $50 per event. Children must wear a badge to enter the Marketplace or attend Mixers. No entrance to the classrooms is allowed. An adult must accompany children at all times.

Contact us for details on receiving a Child Pass at [email protected] or call/text us at 866.936.2587.

Thank you for being interested in featuring Latino Tax Fest! Contact us for details on receiving a media pass at [email protected] or call/text us at 866.936.2587.

Your company must exhibit at the event to qualify for an exhibitor pass. This pass grants you access to the Marketplace, Mariachi Mixer, and Pool Party. Email [email protected] for details.

If you cannot attend the event, you can receive a one-time credit for the full registration fee. This credit can be used for any future event or product in our store within 365 days of purchase.

No hassle refund policy for purchases up to 30 days before the event. If the event is within 30 days of your refund request, there will be a $100 processing fee per ticket.

If no show, no credit or refund will be issued.

If you are asked to leave the premises by event management or property host for cause (i.e., misconduct, inappropriate advance toward others, intoxication, etc.), you will not be issued a credit or a refund.

To request a refund, fill out the “Refund Request Form” and fax it to 831-424-3218. You can also email it to our Accounting Department:

LTP Accounting Department

Phone 866-936-2587 ext 1510

Fax 831-424-3218

Email: [email protected]

Latino Tax Professionals

1588 Moffett St., Suite A

Salinas, CA 93905 U.S.

LAS VEGAS VENUE

MGM GRAND HOTEL & CASINO

3799 S Las Vegas Blvd, Las Vegas, NV 89109

Meet us on the 3rd floor of the convention center

TRAVEL

SOUTHWEST AIRLINES

Get extra reward points and a special discount when you book for the Tax Fest!

Band starts at 7:30 pm

Band starts at 7:30 pm