JOIN US JUNE 22 - 25, 2026!

MGM GRAND HOTEL & CASINO - LAS VEGAS, NV

TAX EDUCATION • NETWORKING • GROWTH

2025 SCHEDULE

Continuing Education – Intermediate

(CA) California Tax Law | (T) Tax Law | (E) Ethics | (U) Updates

Attendees that need to complete 5 hours of California tax law

must be present on Monday, June 16, 2025.

For all other attendees, we will have optional bonus sessions!

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 6:00 pm | Pick-Up Badge at Registration Desk | |

| 9:00 am – 9:50 am | (1T) How to Fill out Form 2848 & Read IRS Transcripts Mark J. Dombrowski, EA | (1T) Cómo llenar el Formulario 2848 y leer transcripciones del IRS Astrid Galvez, EA |

| 10:00 am – 10:50 am | (1T) Penalty Abatement Techniques from Denials to Appeals Mark J. Dombrowski, EA | (1T) Técnicas para la Reducción de Multas: De Denegaciones a Apelaciones Luis Parra, EA |

| 11:00 am – 12:00 pm | Break | |

| 12:00 pm- 12:50 pm | (1CA) California Noncomformity Josue Rojas, EA | (1CA) No conformidad fiscal de California Andres Santos, EA |

| 1:00 pm – 1:50 pm | (1CA) California Tax Law Yadia Lopez, Covered California | (1CA) Reglas de bienes gananciales Raul Escatel Atty. |

| 2:00 pm – 2:50 pm | (1CA) Community Property Rules Raul Escatel Atty. | (1CA) Ley de impuestos de California Yadia Lopez, Covered California |

| 3:00 pm – 3:50 pm | (1CA) Pass-Through Entity Elective Tax Antonio Nava, CPA | (1CA) Factores que disparan auditorías del FTB y errores comunes Raul Escatel Atty. |

| 4:00 pm – 4:50 pm | (1CA) FTB Audit Triggers & Common Pitfalls Raul Escatel Atty. | (1CA) Impuesto Electivo para Entidades de Traspaso Antonio Nava, EA |

| 5:00 pm – 7:00 pm | Meet ‘n Greet | |

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 8:00 am | Pick-Up Badge at Registration Desk | Coffee & Pastries Available | |

| 8:00 am – 8:50 am | (English Only) (1E) Building a Sustainable Practice through Ethics Sharyn Fisk, JD, LLM | |

| 9:00 am – 9:50 am | (English Only) (1U) Nevada Secretary of State Document Preparation Services Irene Jimenez-Muir, Supervisory Compliance Investigator, State of Nevada | |

| 10:00 am – 10:50 am | (English Only) (1U) What’s the forecast for 2025 & Beyond? Keynote Panel: Carlos Lopez, EA; Charles Rettig, Former IRS Commissioner; Terry Lemons, Former IRS Communications & Liaison Chief | |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart, Ballet Folklorico starts at 12 pm! | |

| 1:00 pm – 1:50 pm | (1T) IRS, Immigration & Migrant Taxes Panel: Carlos Lopez, EA; Raul Escatel, Esq.; Nejla Smith, CPA; Astrid Galvez, EA | (1T) El Viaje del Anexo C al 1120-S: El Camino Hacia el Éxito con una Corporación de Tipo S Nadia Rodriguez, CPA |

| 2:00 pm – 2:50 pm | (1T) The Journey from Schedule C to 1120-S: Roadmap to S Corporation Success | (1T) IRS, Inmigración y los Impuestos de Migrantes Panel: Carlos Lopez, EA; Raul Escatel, Esq.; Nejla Smith, CPA; Astrid Galvez, EA |

| 2:50 pm – 3:10 pm | Break Activities: Breakout Sessions | |

| 3:10 pm – 4:50 pm | (2T) Pen to Paper: Preparing a Basic Form 1041 Alice Orzechowski, CPA | (2T) Del Papel al Formulario: Cómo Preparar un Formulario 1041 Básico Luis Parra, EA |

| 5:00 pm – 7:00 pm | Mariachi Mixer | |

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 8:00 am | Pick-Up Badge at Registration Desk | Coffee & Pastries Available | |

| 8:00 am – 9:40 am | (2T) Foreign Assets: Increasingly More Difficult to Hide and Expensive When Caught Alice Orzechowski, CPA |

Luis Parra, EA |

| 10:00 am – 10:50 am | (1E) Understanding Ethics: Violations and Punishment Sharyn Fisk, JD, LLM | (1E) Entendiendo la Ética: Infracciones y Sanciones Luis Tejada, CPA |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart | |

| 1:00 pm – 1:50 pm | (1T) Who has to report their foreign income? Fernando Juarez, Atty. | (1T) Depreciación Ricardo Rivas, EA |

| 2:00 pm – 2:50 pm | (1T) Depreciation Ricardo Rivas, EA | (1T) ¿Quién debe reportar sus ingresos extranjeros? Fernando Juarez, Atty. |

| 2:50 pm – 3:10 pm | Break Activities: Breakout Sessions | |

| 3:10 pm – 4:00 pm | (1T) Audit Reconsideration What, Why, When & How Alan Pinck, EA | (1T) Reconsideración de Auditoría: Qué es, Por Qué ocurre, Cuándo solicitarla y Cómo hacerlo Ricardo Rivas, EA |

| 4:10 pm – 5:00 pm | (1T) How to Survive a Tax Preparer Audit Josue Rojas, EA | (1T) Cómo Sobrevivir a una Auditoría de Preparador de Impuestos Andres Santos, EA |

| 7:00 pm – 10:00 pm | POOL PARTY FEATURING

| |

Time | English Room 363 | Spanish Room 355 |

|---|---|---|

| 7:00 am – 8:00 am | Registration Desk Open | Coffee & Pastries Available | |

| 8:00 am – 8:50 am | (1T) Schedule E Explained: A Line-by-Line Walkthrough for Tax Preparers John Sapp, CPA | (1T) Explicación del Schedule E: Guía Paso a Paso para Preparadores de Impuestos Jesus Casas, CPA |

| 9:00 am – 9:50 am | (1T) Amending & Correcting Returns | (1T) Enmiendas y correcciones de declaraciones Antonio Nava, EA |

| 10:00 am – 10:50 am | (1T) Understanding where to report the income on Form 1099-K Alan Pinck, EA | (1T) Cómo Reportar los Ingresos del Formulario 1099-K Luis Tejeda, CPA |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart | |

| 1:00 pm – 1:50 pm | (1T) Schedule C: Reporting Business Income & Expenses Wolters Kluwer | (1T) Desafíos del ITIN Nejla Smith, CPA |

| 2:00 pm – 2:50 pm | (1T) ITIN Challenges Nejla Smith, CPA | (1T) Schedule C: Reportando Ingresos y Gastos Empresariales |

| 2:50 pm – 3:10 pm | Break Activities: Breakout Sessions | |

| 3:10 pm – 4:00 pm | (1T) Expanded Enforcement: Combating Escalating IRS Correspondence Protection Plus | (1T) Aplicación Reforzada: Enfrentando el Aumento de Correspondencia del IRS Antonio Nava, EA |

| 4:10 pm – 5:00 pm | (1U) 2026 Changes on SSA, TIPS, and TCJA Kristen Keats, CPA | (1U) Cambios de SSA, TIPS y TCJA para 2026 |

* Schedule subject to change to ensure the best experience for our attendees. Please check for updates regularly *

ADVANCED TRACK

Level I: Line-by-Line Tax Filing Guide for Corporations & Partnerships

Join the introductory level I: Corporations & Partnerships Class at Latino Tax Fest from June 17 – 19, 2025, 9 AM – 3 PM each day, for an in-depth look at business tax returns, including Forms 1065, 1120, and 1120-S.

Limited seats available! These sessions will run concurrently with the main sessions, so please choose your track carefully.

Eligibility: Available to attendees with a Tax Pro Pass for an additional fee of $179, or included with the VIP Pass. Purchase at checkout or RSVP for the VIP Pass to secure your spot.

ENGLISH & SPANISH ADVANCED TRACK: SOLD OUT!!

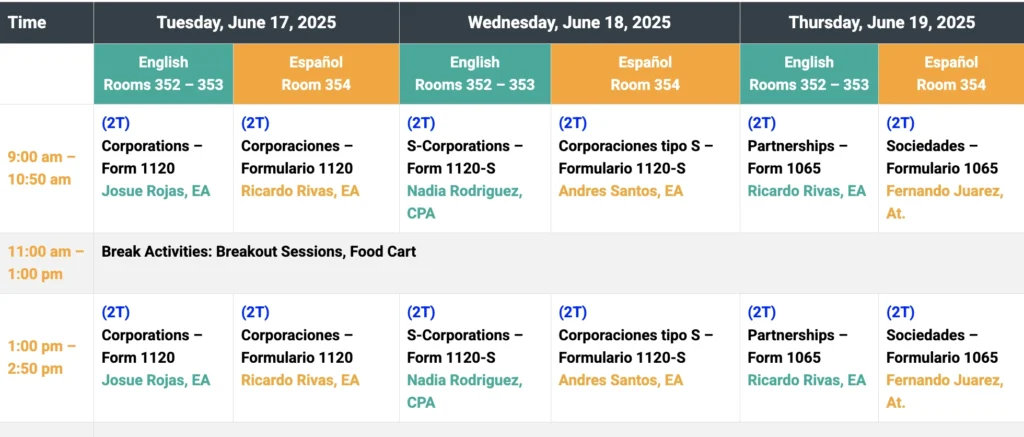

Time | Tuesday, June 17, 2025 | Wednesday, June 18, 2025 | Thursday, June 19, 2025 | |||

|---|---|---|---|---|---|---|

English Rooms 352 – 353 | Español Room 354 | English Rooms 352 – 353 | Español Room 354 | English Rooms 352 – 353 | Español Room 354 | |

| 9:00 am – 10:50 am | (2T) Corporations – Form 1120 Josue Rojas, EA | (2T) Corporaciones – Formulario 1120 Ricardo Rivas, EA | (2T) S-Corporations – Form 1120-S Nadia Rodriguez, CPA | (2T) Corporaciones tipo S – Formulario 1120-S Andres Santos, EA | (2T) Partnerships – Form 1065 Ricardo Rivas, EA | (2T) Sociedades – Formulario 1065 Fernando Juarez, At. |

| 11:00 am – 1:00 pm | Break Activities: Breakout Sessions, Food Cart | |||||

| 1:00 pm – 2:50 pm | (2T) Corporations – Form 1120 Josue Rojas, EA | (2T) Corporaciones – Formulario 1120 Ricardo Rivas, EA | (2T) S-Corporations – Form 1120-S Nadia Rodriguez, CPA | (2T) Corporaciones tipo S – Formulario 1120-S Andres Santos, EA | (2T) Partnerships – Form 1065 Ricardo Rivas, EA | (2T) Sociedades – Formulario 1065 Fernando Juarez, At. |

MEET OUR SPEAKERS

VISIT OUR EXHIBITORS

LAS VEGAS VENUE

MGM GRAND HOTEL & CASINO

3799 S Las Vegas Blvd, Las Vegas, NV 89109

Meet us on the 3rd floor of the convention center

TRAVEL

SOUTHWEST AIRLINES

Get extra reward points and a special discount when you book for the Tax Fest!

Company ID: 99355712

VIP Doors Open at 7:00 pm | General Access at 7:30 pm | Band starts at 8:00 pm

VIP Doors Open at 7:00 pm | General Access at 7:30 pm | Band starts at 8:00 pm