If you cannot attend the event, you can receive a one-time credit for the full registration fee. This credit can be used for any future event or product in our store within 365 days of purchase.

No hassle refund policy for purchases up to 30 days before the event. If the event is within 30 days of your refund request, there will be a $100 processing fee per ticket.

If no show, no credit or refund will be issued.

If you are asked to leave the premises by event management or property host for cause (i.e., misconduct, inappropriate advance toward others, intoxication, etc.), you will not be issued a credit or a refund.

To request a refund, fill out the “Refund Request Form” and fax it to 831-424-3218. You can also email it to our Accounting Department:

LTP Accounting Department

Phone 866-936-2587 ext 1510

Fax 831-424-3218

Email: [email protected]

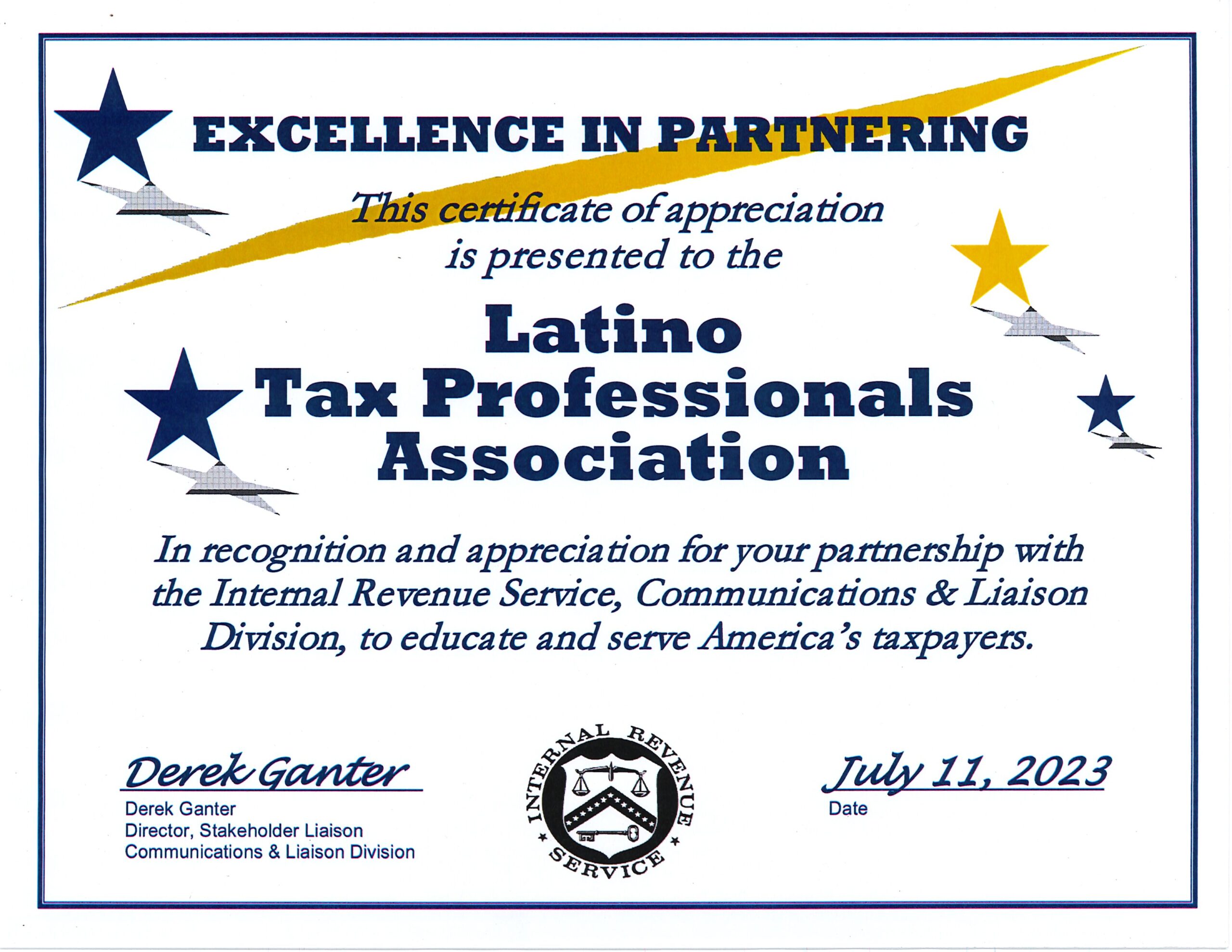

Latino Tax Professionals

1588 Moffett St., Suite A

Salinas, CA 93905 U.S.